There is an array of applications that make money management more efficient than in the past few years. For any of the purposes above – whether budgeting, long-term saving, or building for the future – choosing the right app is vital to an individual’s financial status. Here’s a list of the top financial apps for managing money, including apps for all users.

1. Mint: All-in-One Budgeting Tool

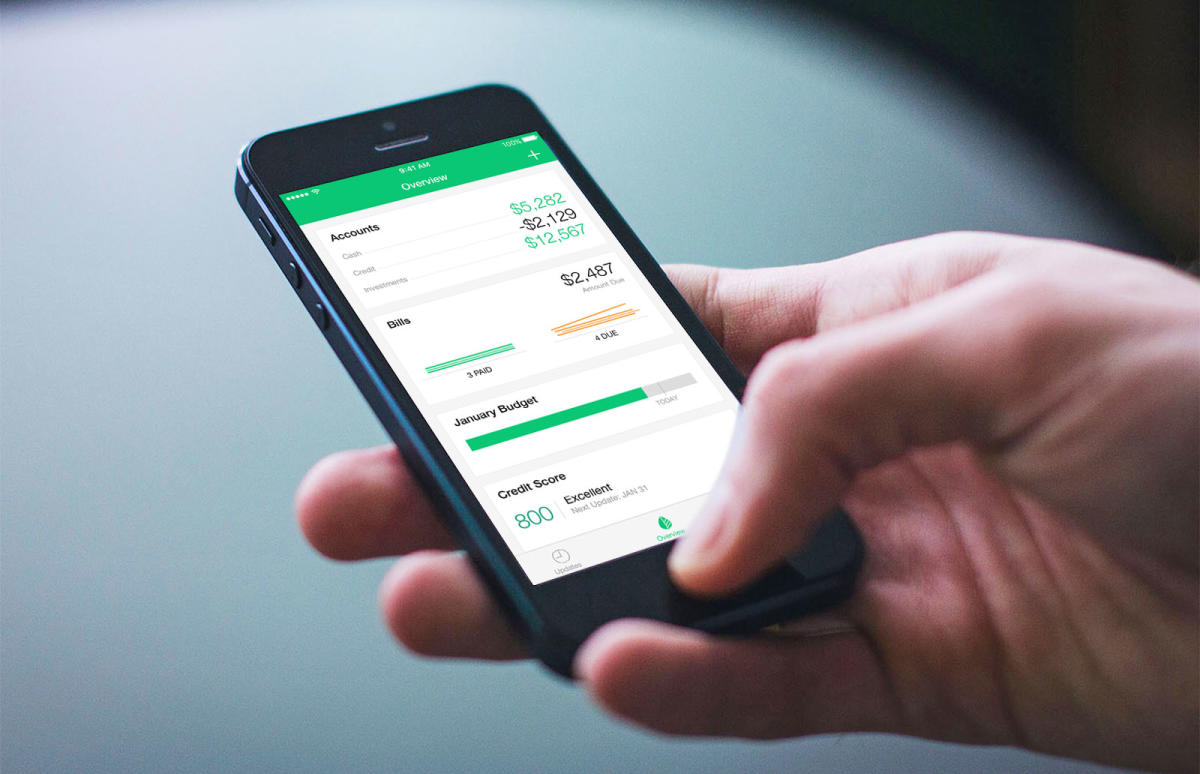

The last finance and investment application under consideration is Mint, one of the most widespread applications for organizing personal finances. For example, it allows one to connect their bank details, credit cards, and bills to monitor expenses. Mint organizes your transactions, assists in creating budgets, and offers information on your expenditure patterns. This is helpful for anyone who wishes to gain insight into his financial position.

2. YNAB (You Need A Budget): Great for Budgeting Enthusiasts

As mentioned earlier, YNAB is helpful for those who follow a budgeting approach and effectively manage money. In this sense, the application persuades all users to give each dollar some function, which implies having a plan for short—and long-term spending. That means it’s an excellent choice for those who would benefit from an app and website to remind them about their spending and saving habits.

3. Personal Capital: Ideal for Investments and Net Worth Tracking

Unlike other apps, Personal Capital provides a total picture of money and the ability to plan and invest. It is a one-stop solution for categorizing daily expenses, savings, and retirement savings. Personal Capital remains a go-to for users who want to create wealth because it allows them to track and calculate their net worth based on investments made.

4. Acorns: Easy Saving and Investing

Let’s explain what Acorns does; it rounds up your daily purchases and invests the change into a diversified portfolio. This application benefits new investors who want to invest in the market without complications. In the long run, small changes add to more significant savings; therefore, Acorns can be considered easy to manage in terms of personal finances.

5. PocketGuard: Keep Your Budget on Track

Pocket Guard is a simple application that outlines the budgeting profile. It enables users to avoid spending beyond their capacity by displaying the remaining amount after completing all the bills and the savings budget. It links with your bank accounts and then automatically groups your spending so you can quickly know how you spend your money. For users who have no complicated needs of budgeting and tracking their finances, PocketGuard is a go-to app.

6. Goodbudget: Envelope-Based Budgeting

Budget is based on the principle of ‘envelope budgeting system where the money is divided into spending categories. Through this app, one can easily set up virtual wallets for food, utilities, social life, and many more. Nonetheless, Goodbudget is especially useful to those who like using tools with little or no automation.

7. Honeydue: Best for Couples

Honeydue is a perfect app for couples who want to be partners in managing their money. It lets two partners keep records, account for each other’s expenditures, and control a certain number of cash inflows and outflows. It also allows users to connect their bank accounts and personal bills and set bill alarms to make it easier for them to check and balance their accounts as a team.

Conclusion

Learning how to handle your money is crucial so that you are not constantly struggling financially, but a correct application will make this much easier for you. We want to divide expenses when we are two people, or we want an application to keep track of the investments, track the financial plan, or split bills; there is something for everyone. Take some time and look at these top choices, and determine which one supplements your financial plan and personality.